The questions before us now are: How much success comes with these

agreements? Is there a trend between the two? The questions before us now are: How much success comes with these

agreements? Is there a trend between the two?In order to find

answers, we have to start with an established definition for these

types of land agreements.

Cash rent involves property rental in which the farmer pays the

property owner a lump sum per year for use of the farmland. In

addition, the landowner may supply extra resources along with the

use of the land. Crop marketing and the timing of input purchases

fall as the responsibility of the tenant, along with the management

of tasks associated with federal aid.

Share rent, or sharecropping as it is also called, is similar to

cash rent, save that the landowner gets a share of the resulting

crop. Under this type of agreement, the farmer and landowner share

crop revenues and production costs; however, both parties also share

the financial risk.

With these definitions in mind, we turn to experts such as

economist Nick Paulson and Professor Gary Schnitkey. Paulson and

Schnitkey both provide findings on these agreements via the

University of Illinois Agricultural Extension and their farmdoc

project.

In 2011, the University of Illinois Agricultural Extension began

looking for a trend concerning these practices. According to those

findings, cash-rent levels increased by 70 percent between 1990 and

2010. Increasing cash-rent levels represented a concern for farmers

in Illinois. Between 1990 and 2010, the average cash rent in

Illinois increased from $100 per acre to $169 per acre, according to

the USDA.

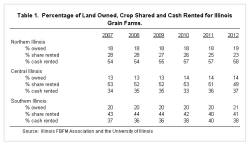

In addition, the findings stated that over the past decade there

has been a shift away from share-rental agreements to cash-rent

arrangements in Illinois. The average ratio of acreage that operated

under a share-rent agreement fell from about 48 percent in 1997 to

37 percent in 2009. Acreage under cash-rent agreements, on the other

hand, increased from just over 25 percent to around 40 percent.

In essence, from those decades we can see a trend of farmers

turning away from sharecropping and moving to cash-rent agreements.

In the years that have followed this earlier study, has that

trend continued?

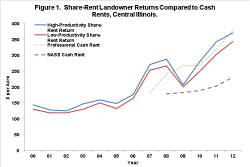

In August of this year, data from Illinois Farm Business Farm

Management was used to calculate returns to share-rent landowners

during the period from 2000 through 2012. Share-rent landowners'

returns increased after 2006. Returns for high-productivity farmland

averaged $343 per acre in 2011 and $371 in 2012. These returns were

above those of average cash rents.

Average cash rents were $179 per acre in 2008, $183 in 2009, $189

in 2010, $203 in 2011 and $231 in 2012. From 2008 through 2012, cash

rents averaged $197 per acre, while share-rent returns averaged $298

and $272 per acre for high- and low-productivity farmland,

respectively.

The data for share rent in 2013 is not yet available.

[to top of second column] |

On the other hand, the data for cash rent in 2013 has been

released by the Illinois Society of Professional Farm Managers and

Rural Appraisers. In addition, the organization was able to create

some predictions for 2014.

-

For excellent-quality farmland, the 2013 cash rent

averaged $388 per acre and the 2014 cash rent is expected to

be $374 per acre, a decline of $14 per acre.

-

For good-quality farmland, the 2013 cash rent averaged

$332 and the 2014 cash rent is expected to be $318, a

decline of $14.

-

For average-quality farmland, the 2013 cash rent averaged

$278 and the 2014 cash rent is expected to be $263, a

decline of $15.

-

For fair-quality farmland, the 2013 cash rent averaged

$224 and the 2014 cash rent is expected to be $212, a

decline of $12.

Lower commodity prices have occurred in recent months, and this

has led to lower projections of 2014 agricultural returns. Lower

returns will have an effect on expectations of 2014 cash rents.

Overall, 2014 cash rents are expected to be slightly below 2013

levels.

The continuing movement away from share-rent leases to

cash-rental arrangements is likely not because of financial returns.

On the contrary, share-rent returns on average continue to remain

higher than those of cash-rent operations. Looking at the data

released by official organizations, it seems that farmers are likely

moving toward cash-rent agreements in order to retain more of the

return generated by the land they work.

In addition, it is suggested by researchers at the University of

Illinois Agricultural Department that a simpler cause may be an

aging farming population that prefers the simpler bookkeeping that

comes with cash-rent agreements.

Comparison of share-rent returns with cash rents will continue to

be of interest in the future. If the current data provides any

indication, it is likely that in an effort to find success, farmers

renting land will continue to move to cash-rent practices.

[By

DEREK HURLEY]

Articles cited:

|